人工智能:微软、谷歌、英伟达因计算成本飙升而获胜-彭博社

Parmy Olson

变得更加昂贵。

变得更加昂贵。

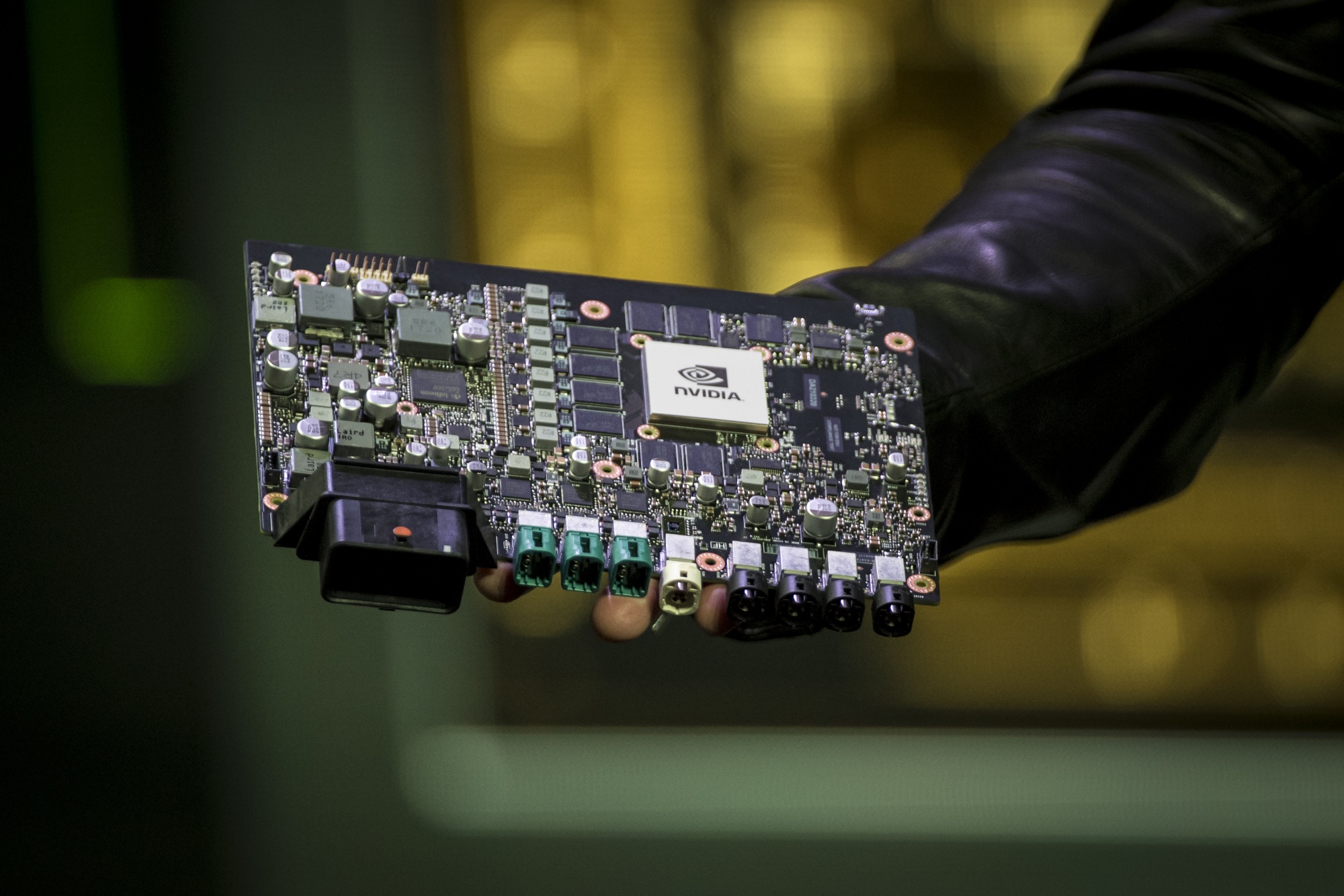

摄影师:David Paul Morris/Bloomberg

山姆·阿尔特曼的 筹集约7万亿美元的目标 来制造人工智能芯片,讲述了一个超越他近乎疯狂野心的故事。首先,构建人工智能所需的基础设施变得异常昂贵。其次,大部分价值仍然 — 仍然! — 控制在少数几家大型科技公司手中 — 而寡头垄断只会变得更糟。

尽管ChatGPT在2022年底推出,激发了激动人心的生成式人工智能市场的一系列新创企业,但大部分新参与者可能会在接下来的一年左右倒闭或被并入现有的公司。对于他们来说,经营成本太高,无法独立生存。

以Sasha Haco为例,她是Unitary的首席执行官,该公司在社交媒体上扫描违规内容的视频。她的公司订阅OpenAI的视频扫描人工智能工具的费用是其客户的100倍。因此,Unitary自己制作模型,这本身就是一种高风险的平衡。她的创业公司需要通过微软公司和亚马逊公司的亚马逊网络服务等云供应商租用这些稀有的人工智能芯片。Haco表示,自2020年以来,这些芯片的价格翻了一番,而且很难预订。“有时我们无法获得所需的资源,因此不得不支付10倍的价格,”她告诉我。

Unitary makes it work, but Haco admits that no generative AI startup has figured out how to run a low-cost business at scale, at least not in the same way that large tech firms have. Another AI founder in San Francisco tells me that some of his peers who have to rent AI chips and cloud computing find that the only way they make money “is if people don’t use the product.”

“The best analogy is electricity,” says Ronald Ashri, CEO of startup Dialogue.ai, which creates tailored chatbots for regulated industries. “You’re plugged into a foundation model and that is your electricity, and you are consuming it constantly. The consumption is the single highest cost in the solution that we deliver to clients.”

Generative AI startups can build their technology in two different ways. They can develop their own version of OpenAI’s GPT-4 or Google’s Gemini for instance, a so-called foundation model that requires hundreds of millions of dollars in investment. Or they can build on top of an existing model, which only needs tens of millions in investment and which the vast majority of AI startups do today.

In both cases, the prime beneficiaries are cloud-computing giants Microsoft, Amazon and Alphabet Inc.’s Google, and AI chip maker Nvidia Corp. “Right now all these startups take money from venture capital investors and give it to cloud companies and Nvidia,” says Rodolfo Rosini, CEO of chip company Vaire Computing. That’s why Nvidia has seen its shares more than double in the last year, putting it near a $2 trillion valuation.

You would think that large tech firms would look across the landscape of AI startups and lick their chops at this dynamic, hungry to acquire new talent and ideas. But it’s not that simple. Most new generative AI startups don’t have many hard-core AI research scientists to make them an attractive way to buy talent, since they’re reliant on the bigger, third-party models. Those startups are often staffed with regular software engineers.

此外,像Meta Platforms Inc.这样的大型科技公司已经在大力投资他们自己的内部人工智能项目,伦敦人工智能风险投资公司Air Street Capital的创始人Nathan Benaich表示,去年许多这样的公司都在大幅削减成本。

更大的障碍是监管。大型科技公司对于任何重大人工智能交易可能引发的反垄断行动都心存顾虑,这得益于最近一波更为严格的反垄断执法。因此,它们转而进行投资。根据市场研究公司Pitchbook的高级分析师Brendan Burke提供的数据,2023年大型科技公司对人工智能初创公司的投资超过了246亿美元,而2022年为44亿美元 — 这种转变旨在避免监管审查。

如今,美国联邦贸易委员会正在调查一些这样的投资 — 包括微软对OpenAI的数十亿美元的投资和亚马逊对Anthropic的投资 — Burke表示,这可能会导致回归传统的收购方式。

风险投资者和初创公司对于未来一年的并购活动持有不同的观点。最有可能发生的情况是:监管压力将阻止对估值超过10亿美元的领先人工智能初创公司(如Perplexity、Cohere、Character.ai和Inflection)的收购,它们将转而吸引投资 — 至少目前是这样 — 而一些较小的参与者将在成本压力下被收购,而其他初创公司则将倒闭。

结果将是一个看起来非常类似于我们今天拥有的游戏领域,最大的玩家继续变得更大。这对于大科技公司和消费者来说是一个胜利,他们将继续获得廉价的人工智能访问。但对于竞争和社会来说却是一个损失。当通用人工智能被少数几家公司主导并融入我们生活的方方面面时,这将赋予这些公司巨大的权力和影响力。我们最好避免这种结果。

更多来自彭博观点:

- 给ChatGPT增加更多内存的人类危险:Parmy Olson

- 如何给AI聊天机器人取名,让用户愿意与其交谈:Dave Lee

- 华尔街裁员显示未来已经到来:Marc Rubinstein

想要更多彭博观点吗? OPIN <GO>。网页读者,请点击 这里 。或订阅我们的每日新闻简报 。